Open your CollegeInvest 529 savings plan

Select your savings plan

Get started by selecting one of the four savings plans below.

Direct Portfolio

Stable Value Plus

Smart Choice

Scholars Choice

Select your

savings plan

personal

information

initial contribution

information

review the disclosure

statement

complete your

enrollment here

Direct Portfolio

most popular plan

A choice of aggressive to conservative investments, age-based options, individual portfolios, and more.

Stable Value Plus

Protects your principal AND guarantees a 1.79% annual rate of return for years 2023 and 2024 (net of fees).

Smart Choice

CollegeInvest’s FDIC-insured 529 savings plan.

Scholars Choice

for financial professionals

Your financial advisor will open your plan on your behalf. This plan offers advisors and investors a variety of great benefits.

SWIPE TO SEE MORE

Not sure which plan is right for you?

Personal information

Account Owner

You or the person who will manage the investment options of the account and the use of funds on behalf of the Beneficiary.

You’ll need their:

- Full name

- Social Security number

- Date of birth

- Mailing address and/or U.S. permanent address

Beneficiary

You, the student, or the person who will use the funds for trade schools and colleges.

You’ll need their:

- Full name

- Social Security number

- Date of birth

- Mailing address

Successor Account Owner

The person who will automatically assume control of the account if the Account Owner should die while the account is open.

You’ll need their:

- Full name

- Social Security number

- Date of birth

- Mailing address

Initial contribution information

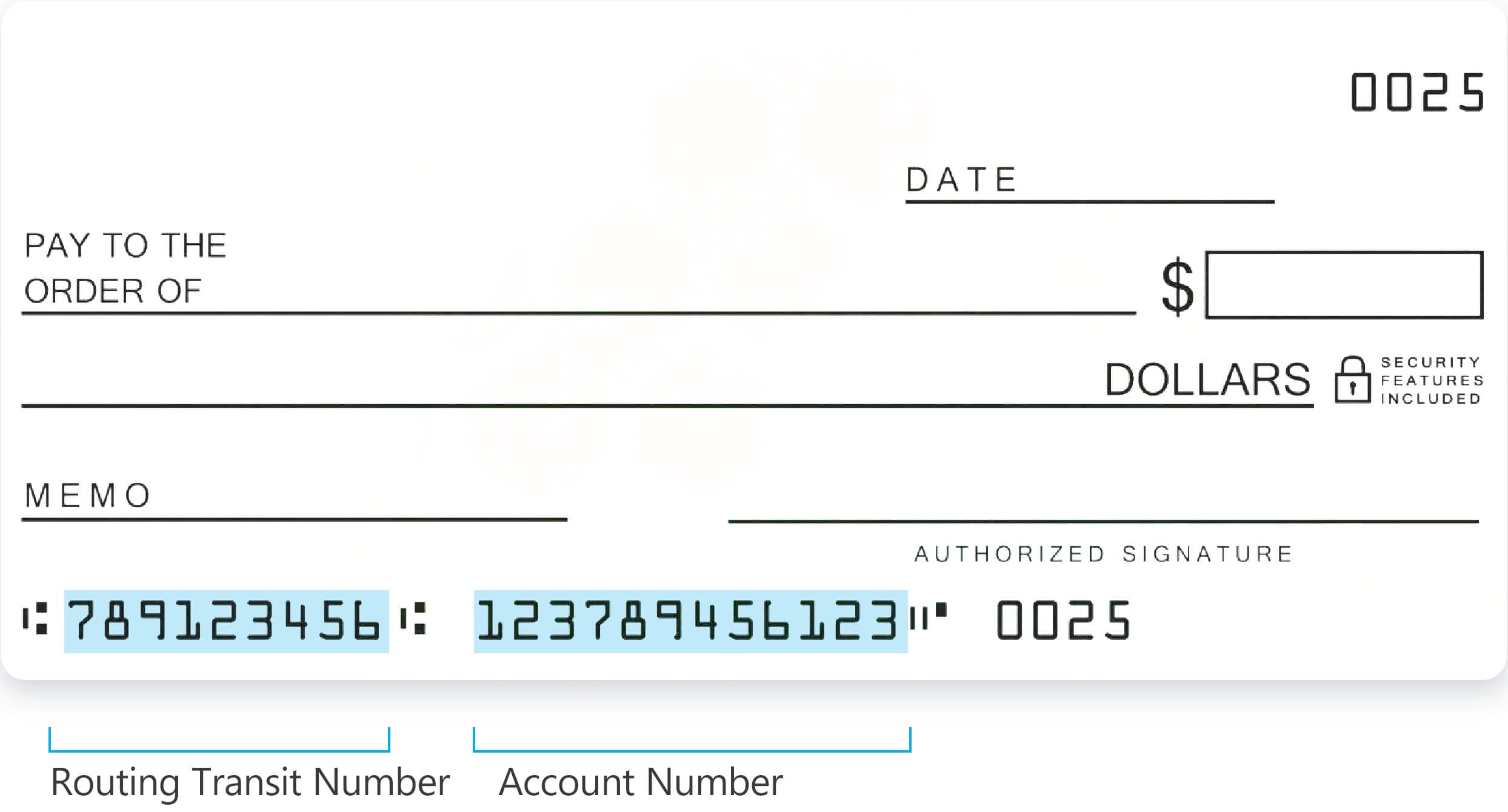

You will need the following information if you would like to make your contribution electronically (minimum of $25) with a one-time transfer, or start an automatic contribution plan, or Payroll Direct Deposit. Additional contributions can be made at a minimum of $15.

Your bank’s name and routing number

Your checking or savings account number

If you would like to make your contribution by mail:

Make your check payable to “CollegeInvest Direct Portfolio College Savings Plan.” You will mail your check and your completed application form to:

CollegeInvest Direct Portfolio College Savings Plan

PO Box 219931

Kansas City, MO 64121-9931

Initial contribution information

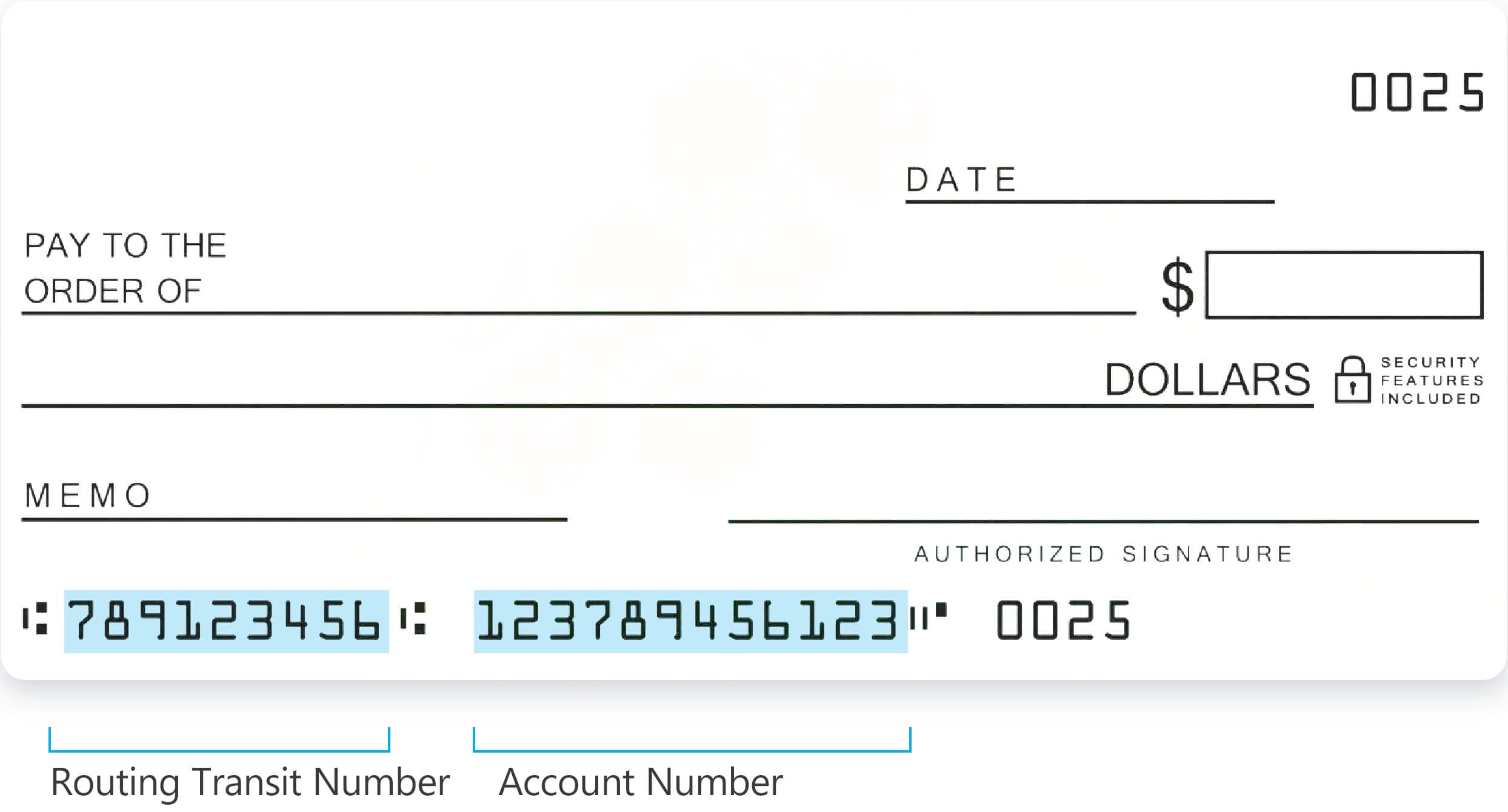

You will need the following information if you would like to make your contribution electronically (minimum of $25) with a one-time transfer, or start an automatic contribution plan, or Payroll Direct Deposit. Additional contributions can be made at a minimum of $15.

Your bank’s name and routing number

Your checking or savings account number

If you would like to make your contribution by mail:

Make your check payable to “Stable Value Plus.” You will mail your check and your completed application form to:

CollegeInvest

1600 Broadway, Suite 2300

Denver CO 80202

Initial contribution information

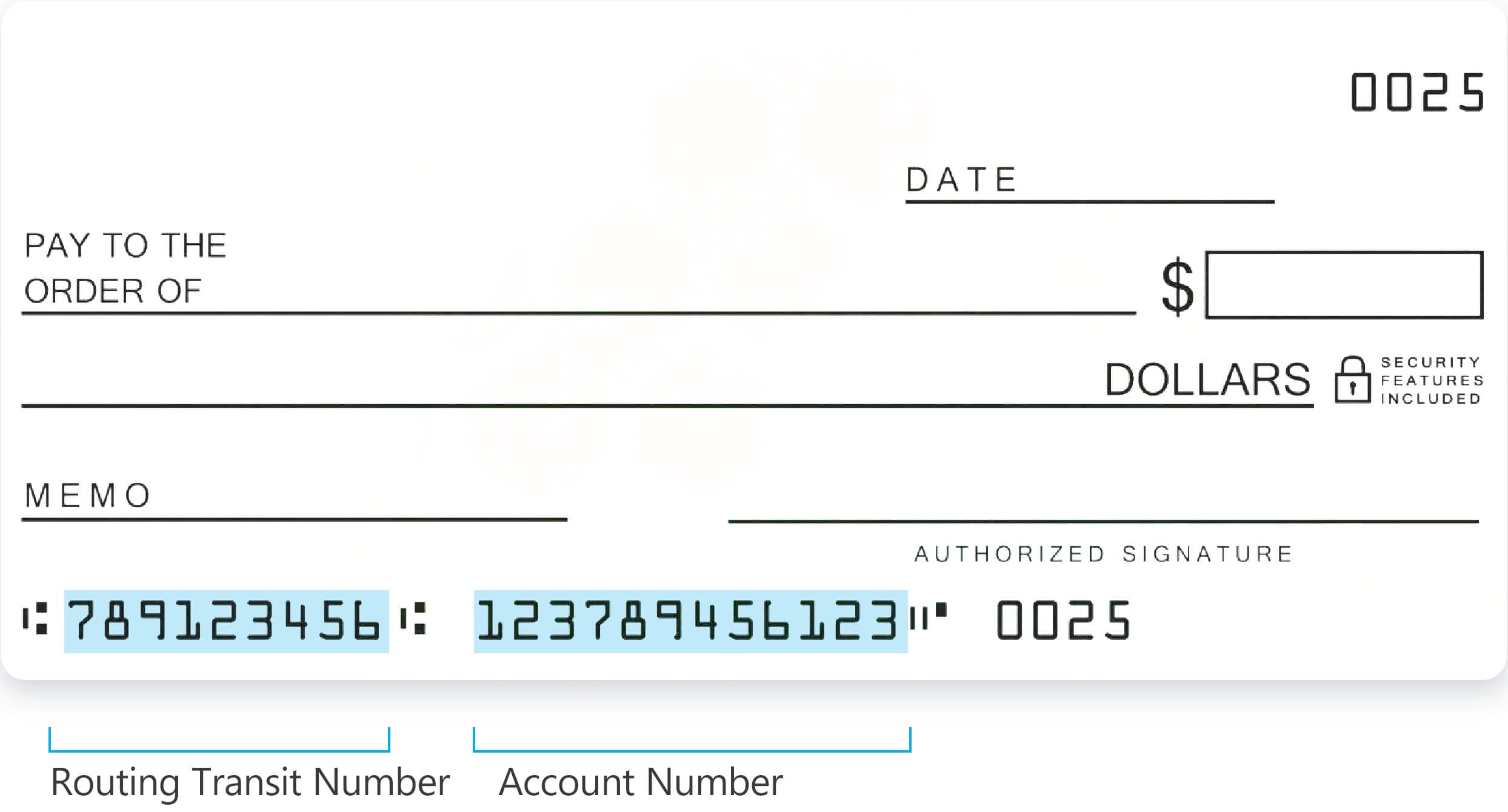

You will need the following information if you would like to make your contribution electronically with a one-time transfer, or start an automatic contribution plan, or Payroll Direct Deposit.

Your bank’s name and routing number

Your checking or savings account number

If you would like to make your contribution by mail:

Make your check payable to “CollegeInvest Smart Choice.” You will mail your check and your completed application form to:

CollegeInvest Smart Choice College Savings Plan

12345 W. Colfax Avenue

Lakewood, CO 80215

You can also open your account and make contributions in-person at any FirstBank location.

Initial contribution information

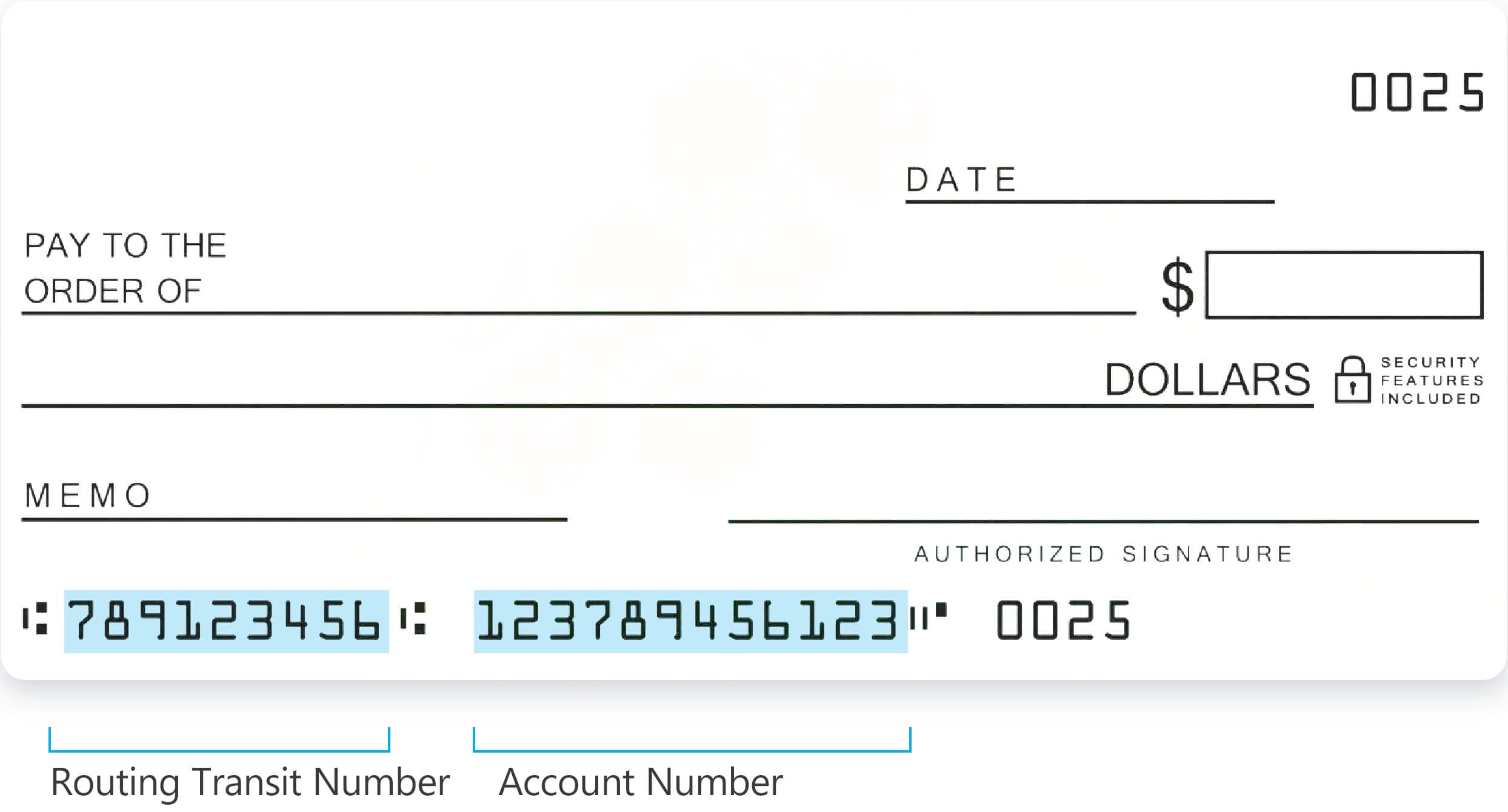

You can open an account only through a financial professional. You can start with as little as $25 and subsequent contributions need to be $25 or more. If you contribute using payroll direct deposit, you may contribute any dollar amount. Looking for a financial professional? Click HERE

Your bank’s name and routing number

Your checking or savings account number

If you would like to make your contribution by mail:

Make your check payable to “Scholars Choice.” You will mail your check and your completed application form to:

Scholars Choice College Savings Program

P.O. Box 219372

Kansas City, MO 64121

Overnight Delivery ONLY:

Scholars Choice College Savings Program

920 Main Street, Suite 900

Kansas City, MO 64105

You’re ready to enroll!

You’ll be directed to your Plan Manager’s site to complete your enrollment.

You’re ready to enroll!

You’ll be directed to your Plan Manager’s site to complete your enrollment.

You’re ready to enroll!

You’ll be directed to your Plan Manager’s site to complete your enrollment.

You’re ready to enroll!

Please consult with your financial advisor to enroll with Scholars Choice.

Investment returns are not guaranteed and you could lose money,

including principal, by investing in these options.