Enrollment Checklist

Now that you’re ready to open an account, let’s review what you will need during the enrollment process.

Account Owner

You or the person who will manage the investment options of the account, and the use of funds on behalf of the Beneficiary.

You will need their:

- Full name

- Social Security number

- Date of birth

- Mailing address and/or U.S. permanent address

Beneficiary

The Beneficiary is the student who will use the funds for college expenses.

You will need their:

- Full name

- Social Security number

- Date of birth

- Mailing address

Successor Account Owner

You may want to name a Successor Account Owner. A Successor Account Owner becomes the owner of the account in the event of the death of the Account Owner.

You will need their:

- Full name

- Social Security number

- Date of birth

- Mailing address

Initial Contribution

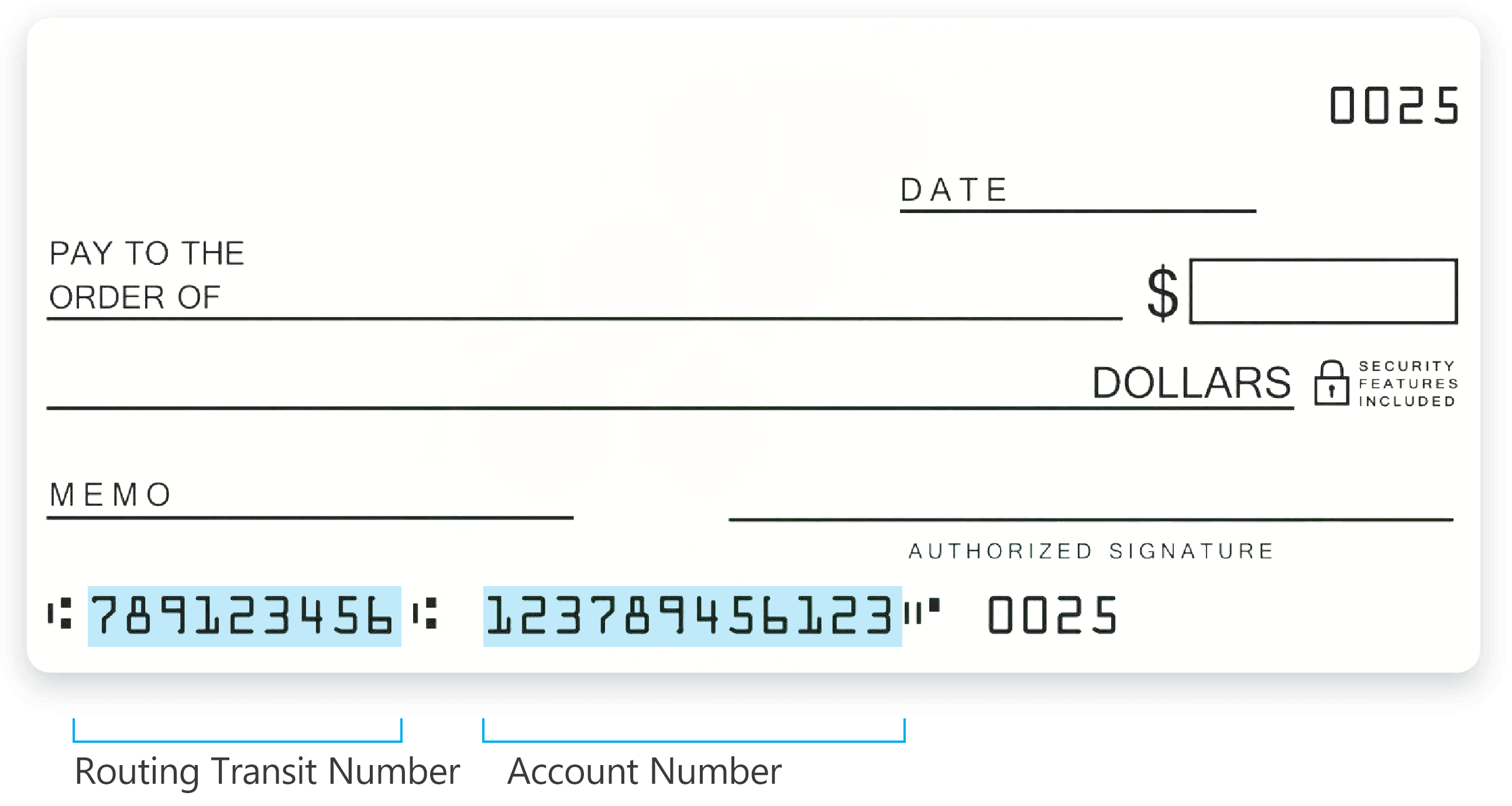

If you would like to make your contribution by mail, look on our website for your particular plan and follow those instructions on where to send your check. If you would like to make your initial contribution electronically or want to establish an ongoing automatic contribution plan, you will need:

- Bank account number

- Bank routing number

- A voided check may need to be submitted

That’s it!

Choose your CollegeInvest savings plan and enroll below:

Direct Portfolio

most popular plan

A choice of aggressive to conservative investments, age-based options, individual portfolios, and more.

Stable Value Plus

Protects your principal AND guarantees a 1.79% annual rate of return for years 2023 and 2024 (net of fees).

Smart Choice

CollegeInvest’s FDIC-insured 529 savings plan.

Scholars Choice

for financial professionals

Your financial advisor will open your plan on your behalf. This plan offers advisors and investors a variety of great benefits.

Not sure which plan is right for you?

Investment returns are not guaranteed, and you could lose money, including principal.