Quick links:

Stable Value Plus

Protects your principal and guarantees an annual rate of return of 1.79% for calendar years 2023 and 2024, net of all fees.

plan managed by:

Investment Management by Nationwide®

Nationwide® is a U.S-based Fortune 100 company with a diversified corporate portfolio and a history of strength and stability dating back more than 90 years. We help financial professionals break down and simplify their clients’ most complex retirement challenges with consultative support, intelligent strategies, award-winning service1, and competitive products. Our wide range of solutions includes annuities, mutual funds, life insurance, and retirement plans. We’re committed to helping America retire successfully and to creating a brighter future for our members and communities. Since the year 2000, the Nationwide® Foundation has committed more than $499 million to charitable organizations, and our associates log thousands of volunteer hours each year.

At Nationwide®, we:

Recordkeep approximately 32,000 plans2

Service more than 2.7 million participants2

Manage and administer more than $165 billion in retirement assets2

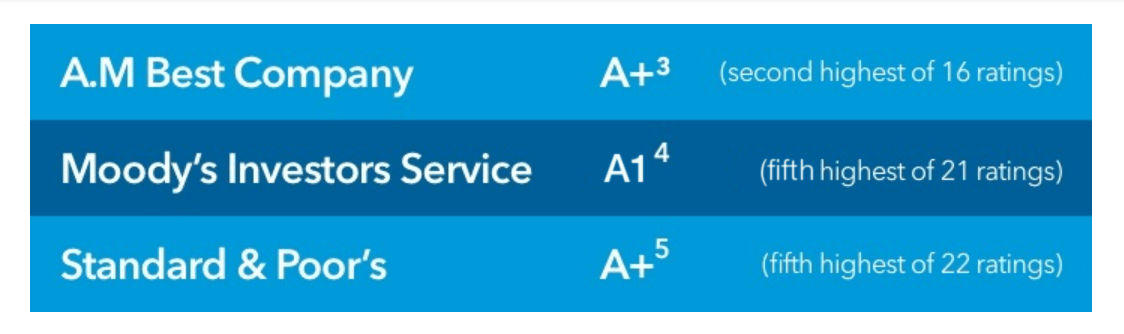

Financial Strength Ratings

The following Financial Strength Ratings represent the opinions of rating agencies regarding

the financial ability of Nationwide® to meet its obligations under its insurance policies.

Investment returns are not guaranteed and you could lose money, including principal, by investing in these options.