Quick Links

CollegeInvest Matching Grant Program

You Invest a Dollar: We Invest a Dollar.

Matching Grant Program application requirements

Please carefully review the Applicant, Beneficiary and Account requirements for the current program year below.

applicant requirements

- You must be a Colorado resident

- You must be able to claim the Beneficiary as a dependent on your Federal Tax forms

- You must be the Parent/Guardian of the 529 CollegeInvest Savings account

- Eligible contributions are contributions made by the Account Owner during the contribution period. Upromise, Ugift, employer promotions and other non-account owner contributions do not qualify for the match.

- You must carefully read and accept the Terms & Conditions

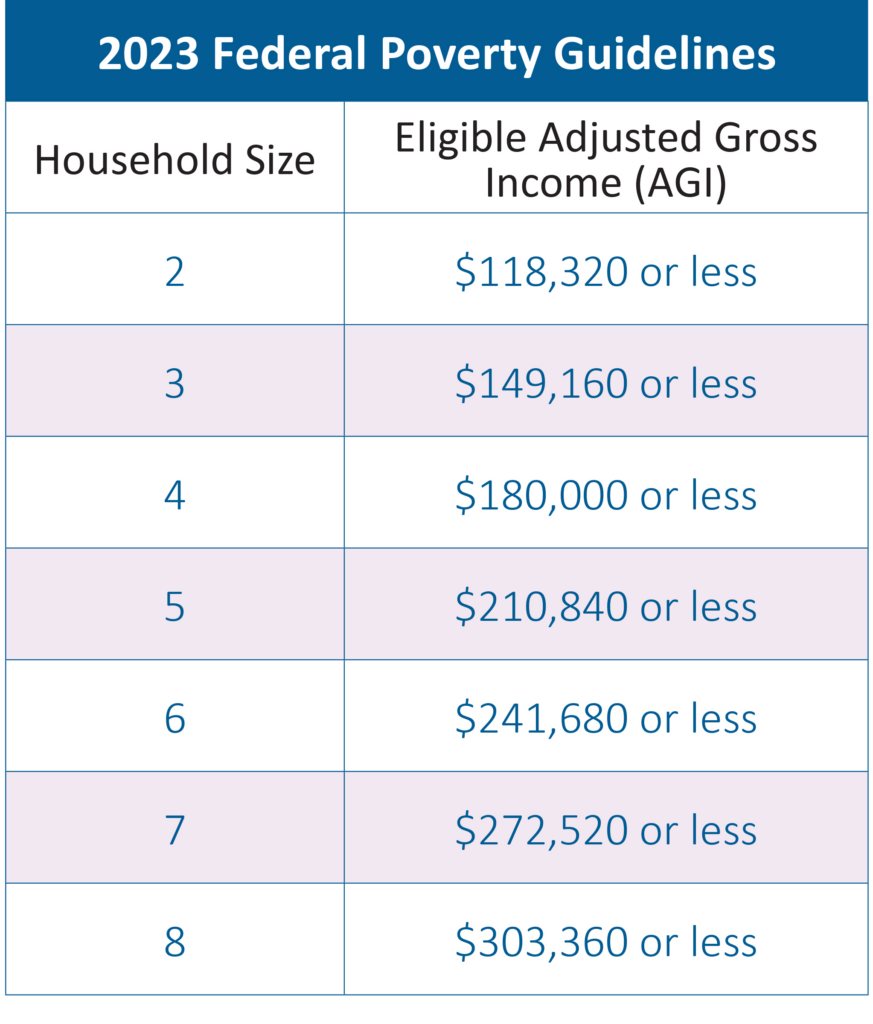

- You must have a Family Adjusted Gross Income (AGI) from the Federal Tax forms that is at or below the figures shown in the income eligibility chart below.

- If filing separately, your AGI must be from all Parent/Guardians in the household Federal Tax Forms

- Note, the AGI is updated every year

Beneficiary Requirements

- Must be the Beneficiary (child, grandchild, etc.) of the CollegeInvest 529 Savings account.

- Must be 8 years old or younger at the time of the initial application

- After the first application year, the Beneficiary does not have to meet the maximum age limit

- Must not be over the age of 18 at the end of the current program year

- No more than one application per Beneficiary per year will be accepted for a Matching Grant in connection with the contributions to their CollegeInvest account(s)

CollegeInvest 529 Account requirements

- Must be open at time of application.

- The account number will be required to apply

- Have the applicant as the CollegeInvest 529 Savings Account Owner

- Have the child as the Beneficiary

- Only one Beneficiary per account

- If you have more than one Beneficiary, you must submit a separate Application Form for each and they must also individually meet the eligibility requirements

- Be funded by the end of the contribution period

- The match is up to the first $500 contributed to the account of the current Program year

Application Checklist

To apply, please have the following information ready:

CollegeInvest 529 Account Owner

Full name and SSN of the Parent/Guardian of the 529 CollegeInvest Savings account.

Federal Tax Form PDFs

PDF of Federal Tax Forms for all Parent/Guardians in the household. If more than one Parent/Guardian in the household and filed separately, please provide both Federal Tax Forms in PDF form. We do not accept password protected PDFs.

Beneficiary Information

Full name and SSN of the Beneficiary.

*Each Beneficiary must have a separate application

CollegeInvest 529 Account Number

Required if open at the time of application.

Ready to apply for the Matching Grant Program?

New applicants

- Be sure to have checked the eligibility requirements for the current Program year above.

- When you’re ready, apply online during the current program year application period, noted above.

- We do not accept password protected Federal Tax Forms.

Previous applicants

Be sure to have checked the eligibility requirements for the current program year above

When you’re ready, log in to your existing Matching Grant Program account to apply for the upcoming Program year. You can also use your Matching Grant Program account to:

- check your application status

- check your award history and account balance

- request withdrawals from your previous awards

- contact our customer team

How else are we helping families?

First Step Program

First Step is a new program recently passed by the Colorado legislature and CollegeInvest, offering a free $100 gift for every newborn or adopted child in Colorado on or after January 1, 2020 to jump-start your way to saving for their higher education.

Collegelnvest 529 Scholarship

The 529 Scholarship is closed to new participants.