Quick links:

Scholars Choice

529 Education Savings Plan

Investment Options

The Scholars Choice Program offers a menu of 28 investment options, including highly rated underlying funds.

plan managed by:

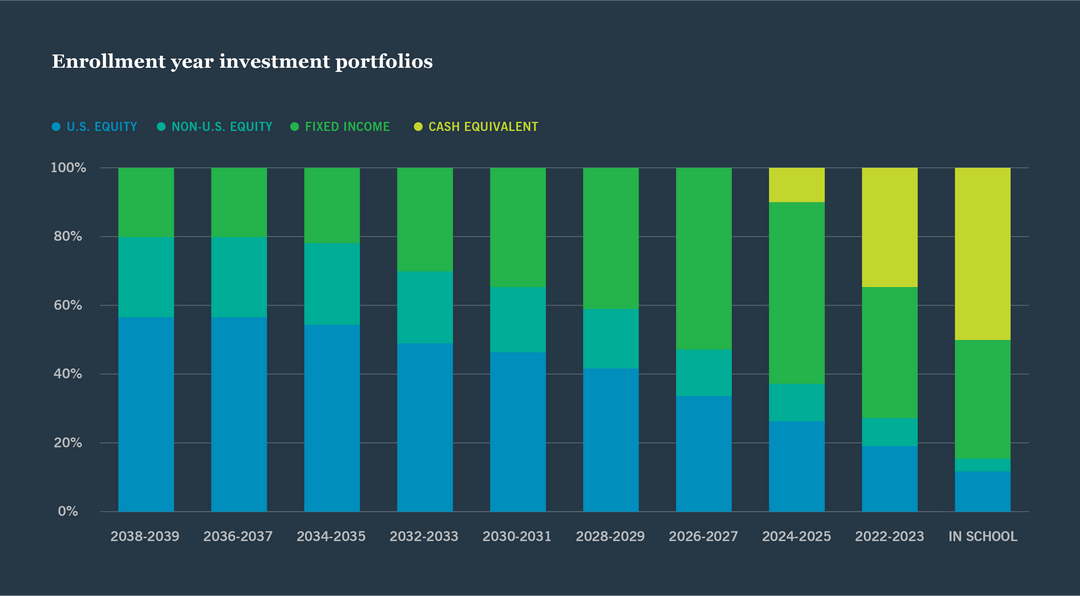

Enrollment year investment portfolios:

Select your enrollment year

Your first step is to determine the expected enrollment year of your future student. Next, select the Enrollment Portfolio closest to the date of enrollment. Example: for a future student who is currently 5 years of age who will likely begin postsecondary school at 18 years of age, you would select the 2034/2035 Enrollment Portfolio.

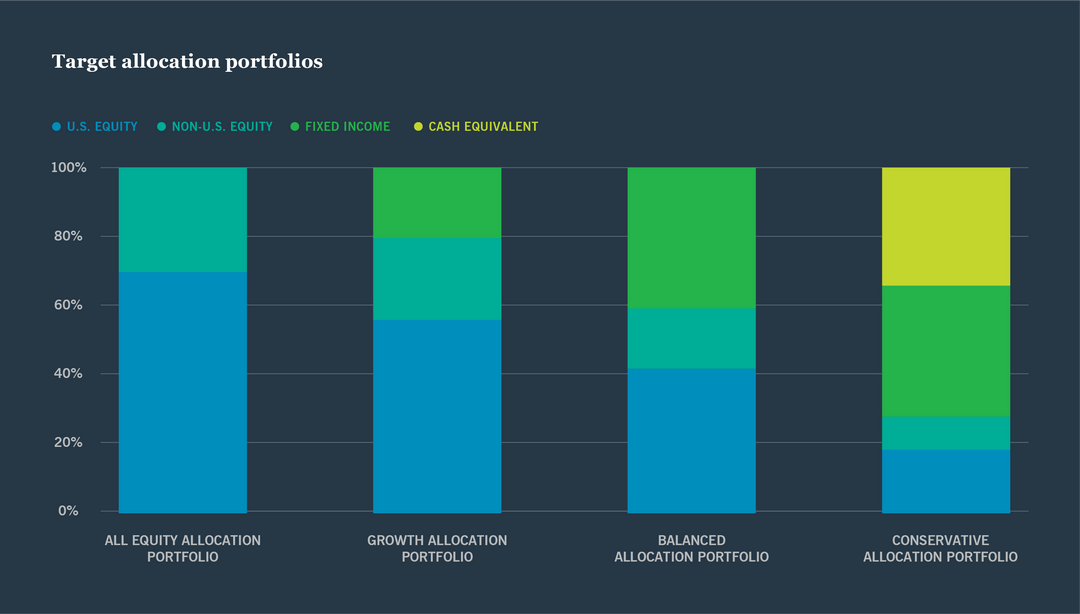

Target allocation portfolios

Scholars Choice offers four Target Allocation Portfolios. These portfolios are designed for those who prefer a diversified investment portfolio with a fixed risk level rather than a risk level that changes as the designated Beneficiary ages. Each Target Allocation Portfolio invests in multiple underlying funds. Working with your financial professional, you can select one or more of these to match your personal risk tolerance for education savings, or use them as a starting point before adding other investments and creating a unique portfolio.

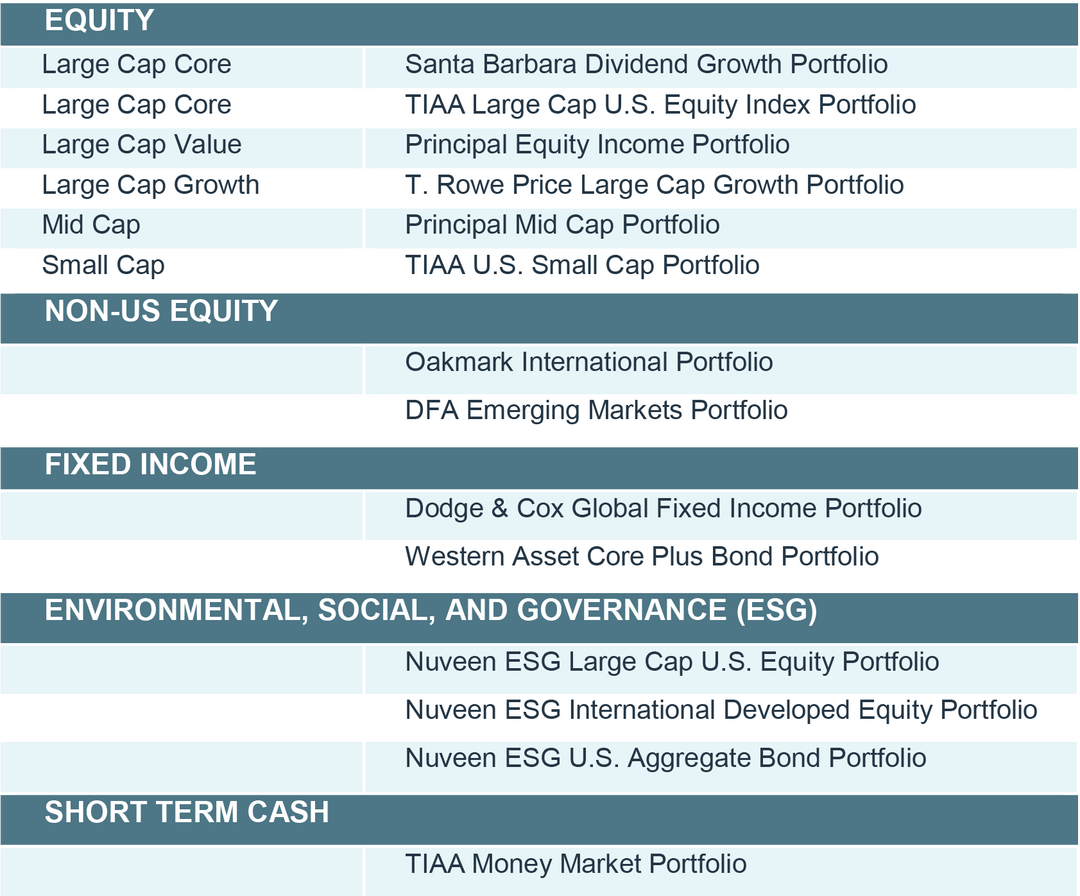

Individual fund portfolios

Scholars Choice offers 14 Individual fund portfolios, including 3 ESG (environmental, social, and governance) portfolios. Each portfolio invests in a single underlying fund.

Customize as you like! Work with your financial professional to assemble your own portfolio and create an asset allocation mix that suits your investing needs. You may invest in as many of the following Individual fund portfolios, Target allocation or Enrollment year investment portfolios, as long as the total allocation equals 100%.

Investment returns are not guaranteed and you could lose money, including principal, by investing in these options.